A Few Reminders on the Eve of “Liberation Day”

Jack and Veronique give some considerations ahead of Trump’s tariff announcement

Tomorrow, President Trump will announce a plan for his latest batch of tariffs on “Liberation Day,” a term he has used to describe the tariffs announced on Wednesday. Ahead of the announcement, Jack Salmon and Veronique de Rugy share some considerations.

A Look at the Data with Jack

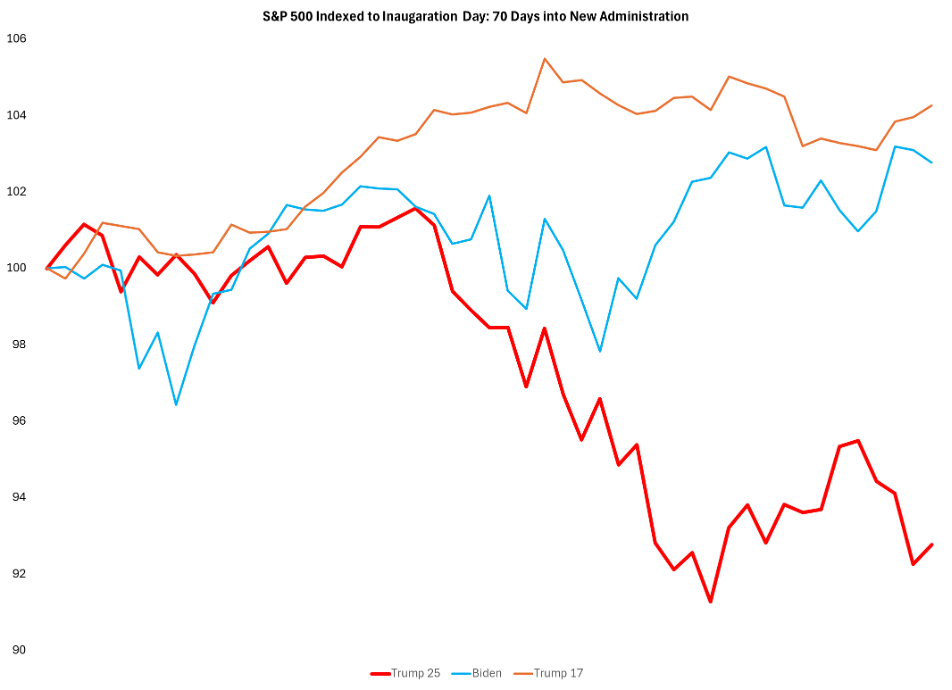

70 days into the new Administration, the stock market is down about 10% since the trade war kicked off.

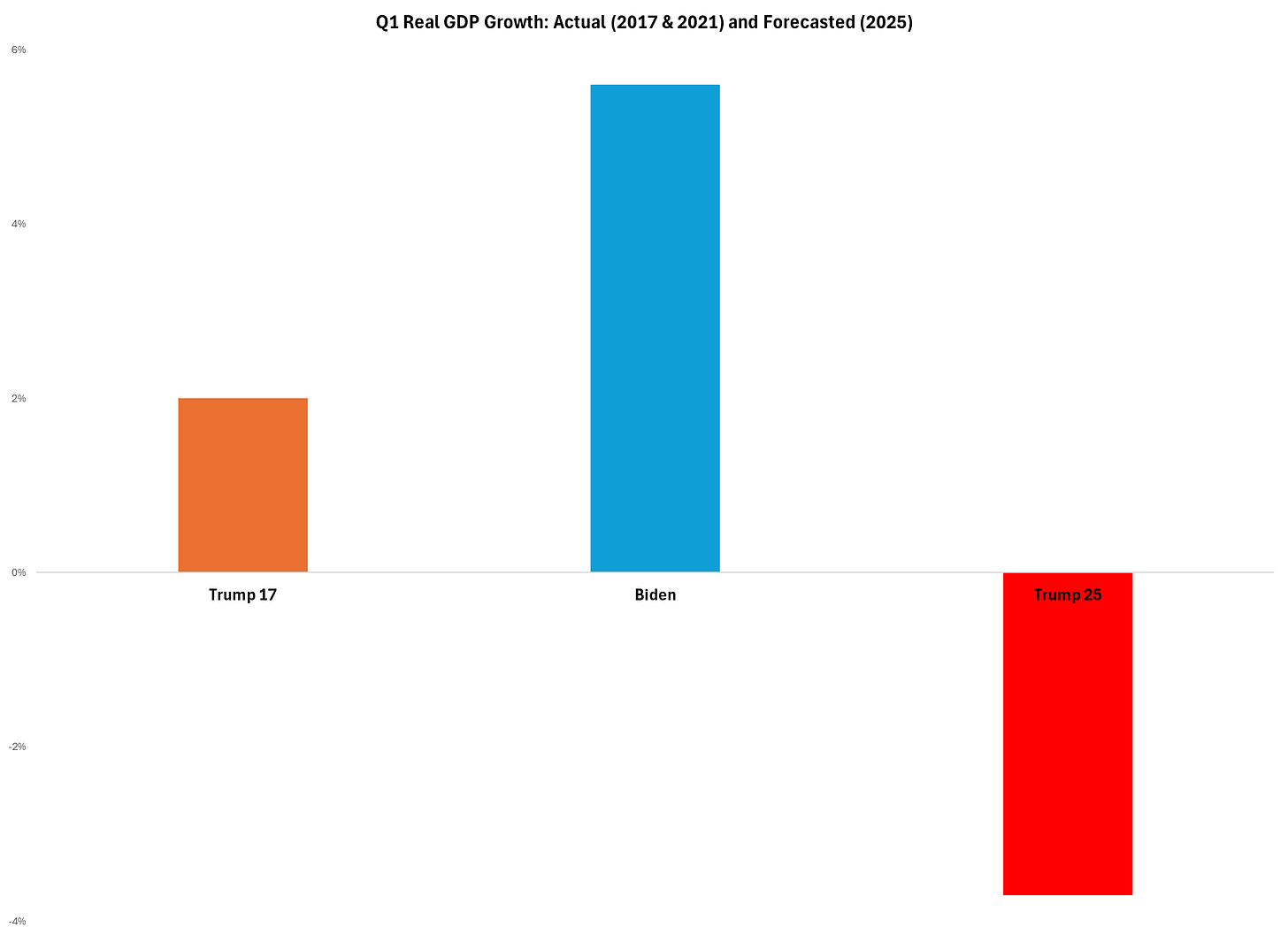

Real GDP is forecast to come in at -3.7% for Q1.

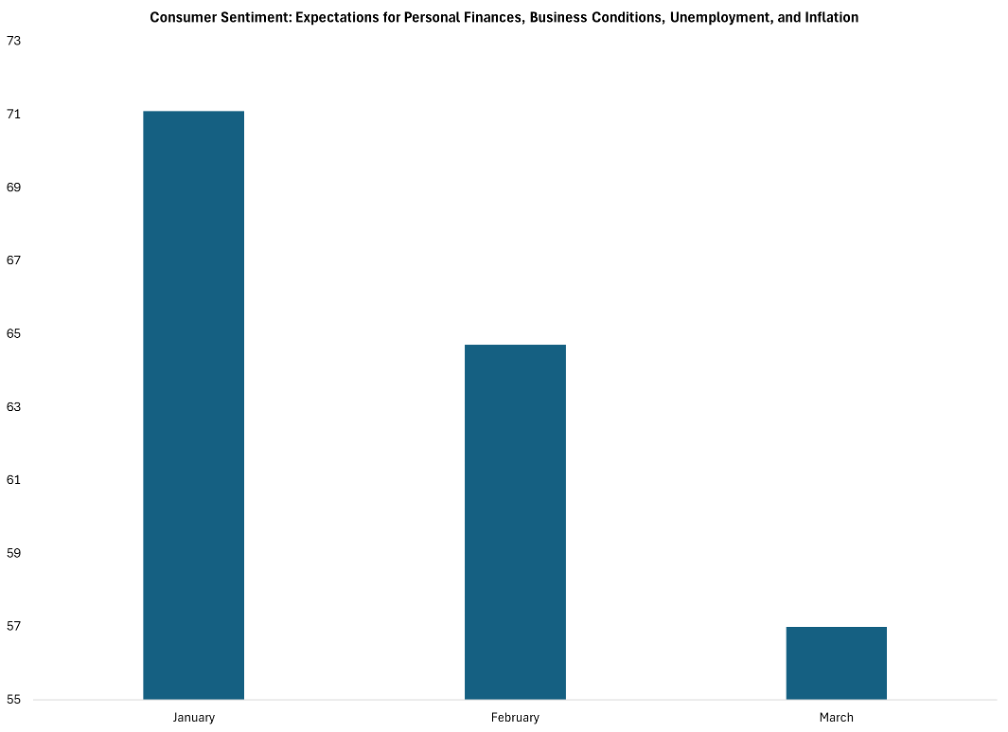

Expectations for personal finances, business conditions, unemployment, and inflation have consumer sentiment falling off a cliff.

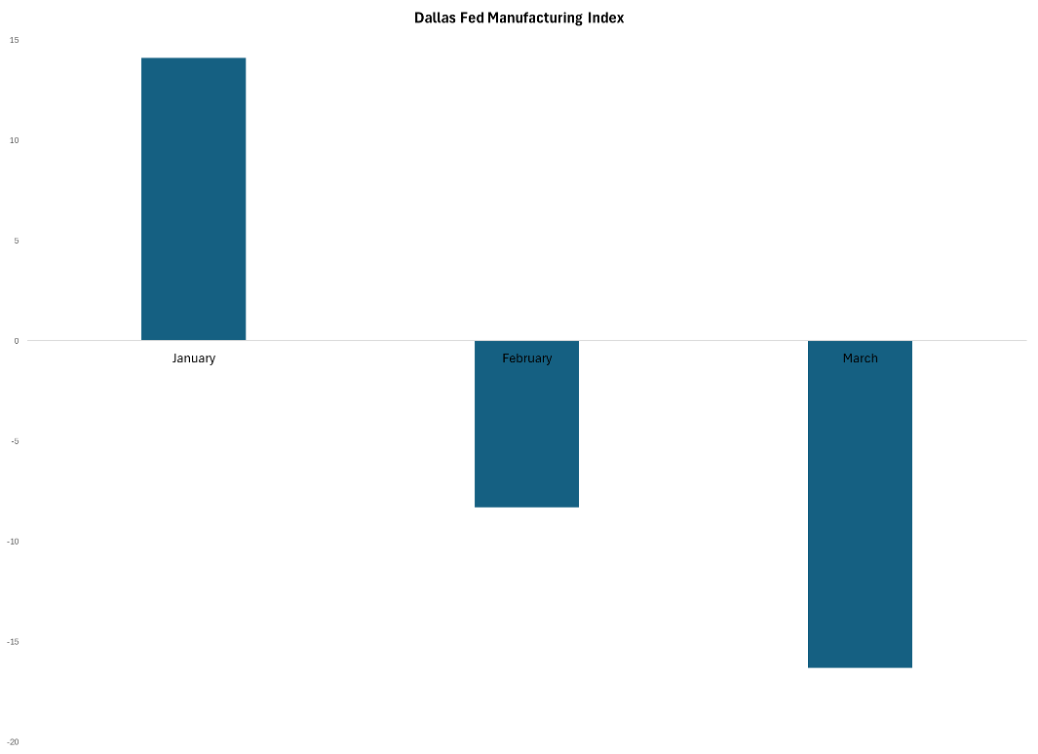

But surely the one sector that we’re told tariffs will benefit is doing better, right? Nope. The manufacturing business activity index has also fallen off a cliff, turning sharply negative.

Economic data thus far doesn’t suggest that the U.S. economy, consumers, or businesses are feeling particularly “liberated” by the ongoing trade war.

Veronique Debunks Some Myths on Tariffs

In a recent Wall Street Journal op-ed, investor Robert Michaelson called for a sweeping return to high tariffs in order to rebuild American industry, restore national power, and protect workers from foreign competition. The argument is emotionally resonant and politically seductive. It taps into myths about hollowed-out towns, industrial decline, and wage stagnation.

But Michaelson’s argument collapses under scrutiny. U.S. tariffs are not a strategy. They’re a tax on Americans. And these levies distort prices as they create monopoly power. They merely repeat some of history’s most familiar economic mistakes.

Let’s debunk some of the myths peddled by Michaelson.

Myth #1: America in the Past Thrived Under Tariffs

Tariff advocates love to romanticize the 19th-century U.S. economy as a model of protectionist success. It’s true that America had tariffs back then. However, for all of that century, tariffs were a major source of revenue; only during a few periods did the protectionist intent outweigh the revenue-raising intent. Obviously, contrary to Mr. Trump’s apparent belief, tariffs that raise lots of revenue provide little protection (because no revenue is raised on imports that are kept out of the country), and tariffs that provide lots of protection raise relatively little revenue.

It’s also true that back then we had nearly unparalleled advantages: a very small government, vast natural resources, open land, mass immigration, a fast-growing internal market, and lots of entrepreneurial spirit. The U.S. was an economic giant in the making, regardless of its trade policy.

Oh, and as Phil Gramm and Don Boudreaux point out, those 19th-century periods when average tariff rates were rising saw slower industrial growth than those when rates were falling.

Furthermore, periods of high protective tariffs of the sort the president seems to have in mind were often a source of political favoritism and corruption, and economic decline, not genius. And when tariffs became truly globalized and retaliatory—as with the Smoot-Hawley Tariff Act of 1930—they helped deepen the worldwide depression. Over 25 countries retaliated against Smoot-Hawley with tariffs of their own. Global trade collapsed. Jobs were lost. Bankruptcies skyrocketed.

Trade liberalization after World War II reversed this course. Under the GATT and later the World Trade Organization, countries reduced barriers, global trade soared, and the U.S. became not only richer but also militarily stronger. We built coalitions, not tariff walls—and it worked.

Myth #2: Trade Deficits Are a Sign of Economic Decline

This is perhaps the most persistent economic misconception in modern politics. The U.S. has run annual trade deficits, without interruption, for nearly five decades. Someone who graduated from high school in 1976, when this run of trade deficits began, reached retirement age in 2023—a long-enough period to have impoverished Americans if such impoverishment is the result of trade deficits. But U.S. trade deficits have not impoverished us. Over the past half-century, we’ve grown richer, more innovative, and more globally dominant.

Moreover—and contrary to popular myth—trade deficits are not debt. They create no invoices that we’re on the hook to pay. They arise simply whenever we import more than we export in dollar terms, with foreigners investing in America all the dollars they don’t spend on American exports. (Some of these investments can and do take the form of loans to Americans, but it’s not the case that trade deficits by their nature are debt.)

Foreigners sell us goods and then reinvest the proceeds in America—buying Treasury bonds, investing in startups, acquiring property, and building factories. That’s a vote of confidence in the U.S. economy.

A related error is mistaking America’s so-called “goods trade deficit” for the overall trade deficit. Nearly four-fifths of the U.S. economy is services. No surprise: We have a “services trade surplus.” Now it’s true that we nevertheless import more goods and services than we export. But it’s utterly meaningless to talk about a “deficit” in the trade of one type of output (tangible things) while ignoring trade in another (intangible things).

Oh and by the way, what decline in manufacturing?

Myth #3: Tariffs Will Rebuild Manufacturing and Secure Investment

Protectionism is a short-term political win that ensures long-term economic woe. Yes, tariffs may help a specific sector survive, at least in the short-term, but they hurt everyone downstream who depends on imported inputs—producers such as U.S. automakers, construction firms, and appliance manufacturers. When you tax one input, you tax the entire supply chain.

Tariffs also signal to investors that the U.S. economy is no longer open and competitive, but rather more subject to political interference. That undermines long-term planning, especially in globally integrated sectors like aerospace, semiconductors, and pharmaceuticals.

True investment security comes not from shielding firms from competition, but from ensuring a stable, rule-based, low-tax environment with access to global talent, capital, and markets. Tariffs do the opposite.

Myth #4: Other Countries Cheat—So We Should Too

Yes, China manipulates its currency and subsidizes exports. Yes, Europe uses VAT systems that some argue create asymmetries (I don’t). But these realities don’t justify crippling our own consumers and producers.

If China wants to tax its citizens to subsidize goods for Americans to consume, they’re making a poor policy choice that hurts them and benefits us. Again, manufacturing in America is doing really well. Responding with protectionism is like slashing your own tires because your neighbor overpaid for his.

Instead, the U.S. should use the WTO, trade agreements, and coordinated diplomacy to address allegedly “unfair” practices. In strategic sectors—like semiconductors—we can target investments and build alliances, rather than cut ourselves off from global innovation.

Retaliating against foreign “cheating” with blanket tariffs hurts us more than it helps us and plays directly into the hands of bad actors abroad who want to weaken American global leadership.

Myth #5: Free Trade Only Benefits Elites

This is a comically mistaken view of how markets work. The reality is that every American benefits from trade—especially the poor and working class. Open trade reduces prices on everyday essentials: food, clothing, electronics, and household goods. It increases choice and competition. For families living paycheck to paycheck, this benefit is not trivial—it’s thousands of dollars a year in savings.

Yes, trade creates changes. But so does automation—which is behind a vast majority of the reduction in jobs in manufacturing—and even recessions. The solution isn’t to make goods more expensive for everyone; rather, it’s to help people move, retrain, and find new opportunity. That means upskilling, deregulating housing and labor markets, and letting capital flow where it creates the most value.

But tariffs have the opposite effect. They protect a few politically connected industries by raising costs for the many. That’s not populism—it’s crony capitalism.

Myth #6: Deindustrialization Means the End of American Power

This is a romantic but outdated view of national strength. Power today doesn’t come from steel mills—it comes from technological superiority, supply-chain flexibility, energy security, sophisticated and deep financial markets, and advanced human capital.

As I mentioned before, the U.S. still produces a tremendous amount of industrial output—more than ever in real terms. But modern manufacturing looks different: It’s capital-intensive, lean, and integrated into global networks. The idea that we don’t “make things anymore” is false. We just don’t do it the way we did in 1950.

Where national security is genuinely at stake, there’s a role for targeted investment and resilience planning, as long as we understand there will be a cost to pay. But turning the whole economy inward under the banner of self-sufficiency is not security—it’s fragility.

The Bottom Line: Tariffs Are a Blunt, Regressive, and Costly Tool

Tariffs might sound simple and patriotic. But they are a hidden tax on consumers and businesses. They invite retaliation, slow innovation, and entrench rent-seeking. They hurt the very workers and industries their supporters claim to protect.

There are better ways to build an inclusive, resilient, and dynamic economy:

Embrace open markets.

Encourage innovation through stable rules and light-touch regulation.

Build alliances with partners who share our values.

The path to prosperity is not through closing doors; it’s through opening opportunities.

The first Trump-era trade wars showed us what tariffs do: They raise prices, invite retaliation, and cost taxpayers billions in bailouts. We shouldn’t be eager to repeat that mistake.